Is Debt Consolidation Right for You? Here’s What You Need to Know

Debt can quickly feel overwhelming, especially when multiple bills are piling up each month. If…

Debt can quickly feel overwhelming, especially when multiple bills are piling up each month. If you’re juggling various payments and wondering how to simplify things, debt consolidation might be worth considering. While it’s not a magic fix, debt consolidation can be a solid alternative to more drastic measures, like bankruptcy. However, it’s essential to know exactly what it covers and how it works before you jump in.

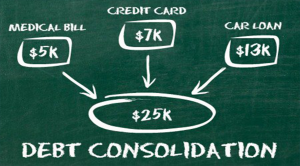

What Is Debt Consolidation?

In simple terms, debt consolidation combines multiple unsecured debts, like credit card bills, student loans, medical expenses, and taxes, into a single loan. This means you’ll make one monthly payment instead of several, often with a lower interest rate. However, it’s important to remember that only unsecured debts are typically eligible for consolidation. Secured loans, such as mortgages or car loans, aren’t included.

Before signing up with any debt consolidation company, take the time to research thoroughly. Understand the terms they’re offering, what’s included in the agreement, and make sure to read the fine print.

How Debt Consolidation Works

Here’s how the debt consolidation process usually goes: the debt consolidation company pays off all your eligible debts, combining them into a single loan. From there, you’ll make monthly payments to the consolidation company, covering both the loan and any interest.

Some companies will even negotiate with your creditors to try to reduce the principal balance, lower the interest, or eliminate extra fees. Many creditors are open to these kinds of negotiations, preferring to receive some payment rather than risk getting nothing if a borrower files for bankruptcy.

Why Consider Debt Consolidation?

Debt consolidation isn’t just about merging debts into a single payment; it’s also a way to get guidance from professionals who can help negotiate your debt and offer budgeting advice. This approach can be helpful if you’re feeling buried under bills but want to avoid the long-term credit consequences of bankruptcy. Debt consolidation can help you create a realistic plan to pay down your debt while improving your credit over time.

First Steps: Debt Counseling

If you’re considering debt consolidation, start by talking with a credit counselor. Many nonprofit credit counselors offer free services and can provide insights into debt consolidation options, tailored advice for your financial situation, and recommendations for managing your debt effectively.

Exploring Other Options: IVA and More

If you find yourself in serious financial difficulty, an Individual Voluntary Arrangement (IVA) may also be worth exploring. This is a legal agreement in the UK between you and your creditors that allows you to pay off your debts over time at an agreed-upon rate. While it’s not the same as debt consolidation, an IVA can be a viable option if you’re trying to avoid bankruptcy.