Investing in gold – should you buy physical gold, ETFs or mining stocks?

Gold is usually held as a hedge against risk and volatility, but only investing in…

Gold is usually held as a hedge against risk and volatility, but only investing in physical gold can effectively eliminate counterparty, systemic and market risk, thereby performing its hedge function properly.

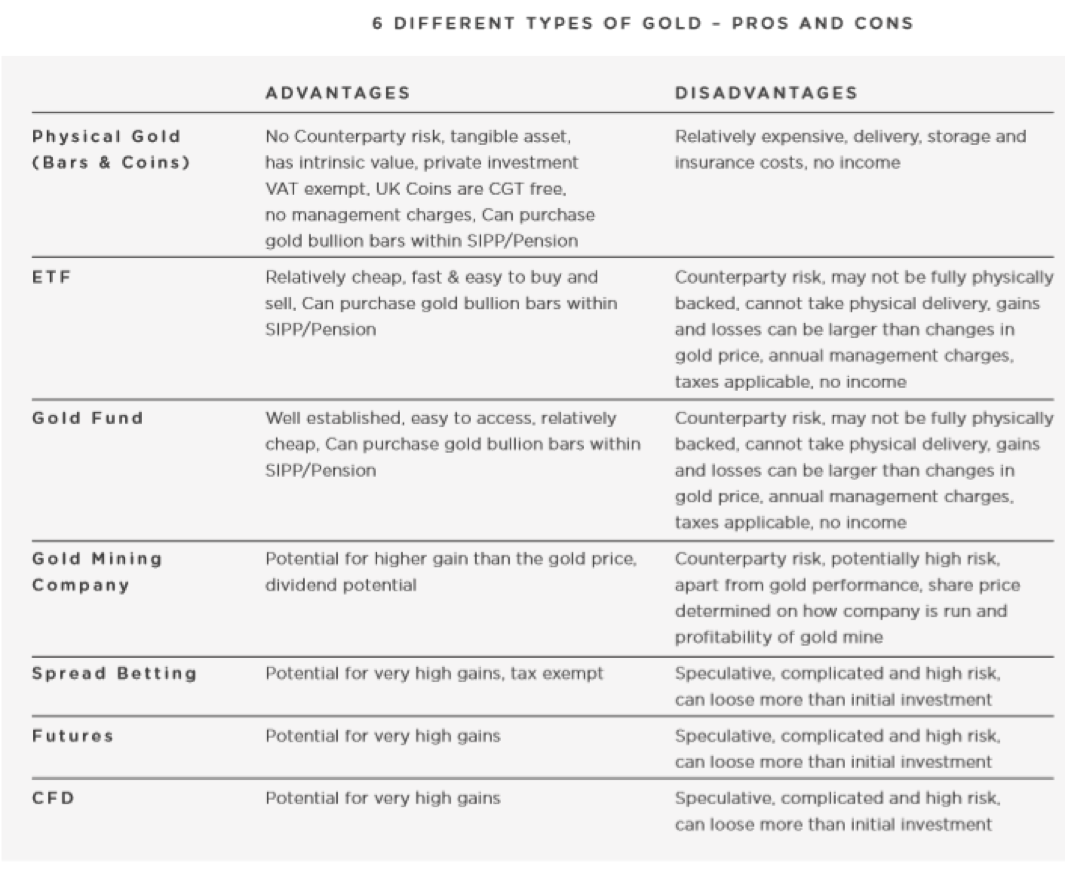

Most investment advisors suggest holding some percentage of gold in a portfolio, often between 5% and 15% depending on the level of protection required. But there are several ways to satisfy an appetite for the shiny stuff, namely owning the physical metal, buying Exchange Traded Funds, or investing in miners who dig it out of the ground. All these ways of investing in gold are well established and easy to add to your portfolio, but they all satisfy a different aspect of risk and return.

Physical gold is the only form of the precious metal that is outside the financial system, and this is an important advantage in these volatile political and economic times. Josh Saul, CEO of The Pure Gold Company says: “We’ve had a 98% increase in financial professionals liquidating electronic gold (including ETFs and miners) to purchase physical gold in 2018. They cite systemic risk in global markets as the main reason for wanting to own the underlying asset rather than a financial product that is subject to the vagaries of the market and its institutions.

Physical Gold Vs ETFs

One of the key advantages of owning physical gold is the removal of counterparty risk. The gold itself belongs to the buyer rather than being held or underwritten by a counterparty, usually a major bank.

Gold-backed Exchange Traded Funds are funds in which you can trade shares like a stock. As the name implies the shares are backed by underlying physical gold stores and it tracks the gold price. In most cases, it’s unlikely that a holder of a gold-backed ETF would be in a position to cash in their shares for physical gold, because the threshold for physical delivery is usually too high (over a million dollars for the most popular ETF). There is also some scepticism about whether the funds actually hold the full gold equivalent to back up the shares in their fund.

But even if you can’t liquidate your shares into gold, you still have to rely on the fund to honour your investment. The fund is the first counterparty that comes with the risk of default, but it’s not the last. The fund will inevitably use a financial institution to source and store the gold, and they add a second level of counterparty risk to the investment. It’s possible there will be further layers of counterparty risk in certain ETFs.

Many people investing in gold choose it out of concern for the banking system and the very financial structures on which the ETFs are built. While ETFs effectively track the gold price, they can’t eliminate the risk of institutional collapse. Buyers should also be aware that gains and losses to ETFs may be larger than changes in the actual gold price, ETFs incur annual management charges and it isn’t tax free.

It is however a simple, convenient, inexpensive way to track the price of gold in the short term if you are prepared to accept the inherent risks.

These days it is as easy to buy physical gold as it is to buy an ETF. Investment firms like The Pure Gold Company provide a consultative approach to investing in gold which enables either immediate delivery or storage within a secure LBMA approved vault, offering the best gold investment for your circumstances. Some gold coins, like Gold Britannia’s and Gold Sovereigns are legal tender in the UK and thus don’t attract capital gains tax. And there are pension and SIPP vehicles that allow savers to include physical gold in their pension investment portfolio.

Physical gold eliminates counterparty and systemic risk and provides direct exposure to the precious metal. Central banks and investment banks that invest in gold purchase the physical commodity as opposed to electronic versions for the same reason.

Physical Gold vs Miners

But what about the companies that actually produce the gold? Listed gold mining companies are easy to invest in, and their stock should logically rise when the gold price rises, and fall when the gold price falls. But in reality there are a great many other factors that affect the price of mining stocks which means they don’t always reflect changes in the gold price accurately.

Investing in gold mining stocks also means investing in the proficiency of management, the efficiency of operations, and the profitability of the company. In addition, investors take on counterparty risk, country risk depending on where their mines are located, safety risk, debt risk and other organisational risks that affect the share price irrespective of how the gold price performs.

Mining shares are suitable for investors who want exposure to stocks that are indelibly linked to the price of gold. The highs are high but the lows can be very low, which ultimately undermines the objective of investing in gold, namely safety and security.

Conclusion

The lure of gold will always attract investors, but in different forms depending on their requirements. ETFs are often used for short term gain or exposure to the gold price. They are an inexpensive, quick investment vehicle but they come with counterparty risk and don’t bypass the banking system. Miners appeal to risk takers who want stock market exposure that could net them substantial gains but also runs the risk of substantial losses. And physical gold provides an effective hedge against counterparty risk, systemic risk and market risk for the long term investor.