How Debt Consolidation Can Reduce Your Debt

Debt consolidation is a combining of high interest rate debts into one lower interest rate…

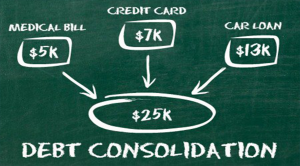

Debt consolidation is a combining of high interest rate debts into one lower interest rate loan. This enables someone with multiple debts to focus on just one payment every month, and for less interest over a longer period of time. Consolidation enables them to pay down their principle each month and clears the balance of their debts much quicker.

Both debt consolidation and settlement solutions are practical ways of moving forward in relation to your debt. This is done by eliminating your credit card and other high interest debts before you have to face bankruptcy. It enables you to pull ahead instead of lagging further behind, and you can get back into good standing in terms of your credit score.

One of the best benefits of these loans is that you can choose the option you need. Most all of your credit card debts and loan debts will have different due dates. This makes it stressful and nerve racking trying to juggle them every month. But with only one payment to make each month, life becomes much simpler and stress free.

A debt consolidation loan can enable you to eliminate or lower the interest and penalties that are on your credit cards. This is done by paying the minimum payment each month with the interest and charges being put together. Then with a debt consolidation program some of that debt amount gets reduced and eliminated that was built by the interest charges. The debt consolidation deals with minimizing or eliminating the interest charges first.

You’ll have a counselor operating on your behalf for representing you to the creditors. They will negotiate to get you the best terms possible, especially in regards to the interest rate. And because of the lower interest your payments will be lower than they were before.

Some of the successful debt reduction programs can help you to eliminate your debt with 2 to 5 years. This saves you both time and money. You can avoid the bill collectors with one of these debt consolidation programs and the company you deal with will talk to them for you.

By taking charge of your situation you can bring your credit score back up to where it should be, and begin to enjoy having a good score once again. It’s a great way to put debt behind you and climb back up to the top of your game. Anyone who is struggling with debt should take a good look at these loans to see if they could be of help to them. If you’re constantly buckling under the weight of several debts each and every month, you owe it to yourself to consider taking out one of these loans and letting go of the stress. And rebuild your credit to where you’re no longer worried about your finances.