A Return to Building a Strong Financial Foundation Worth Talking About

When you need to make sure that you are moving in the right direction financially,…

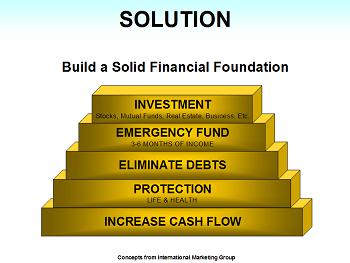

When you need to make sure that you are moving in the right direction financially, you should know that it’s really all about building the right foundation. You want to make sure that you have a foundation for your money to grow, and that can take some time. Yet if you are just starting out, it can be hard to figure out what makes a strong financial foundation. A lot of people know how they would feel if they had a strong financial foundation, but they don’t really know what they would do with an actual strong financial foundation, nor do they know how to build one.

Like most things in life, it’s really not that difficult. Here’s what you need to do.

First and foremost, you will need to make sure that you actually look at how much money you are making. Now, a lot of financial guides ignore the power of income, focusing only on the type of expenses that are coming into the house. However, in order to figure out what type of financial footing that you’re on, you will want to make sure that you think about how much you’re actually bringing in. Now, when it comes to income, you don’t want to just look at your total paycheck. No one really lives by their total paycheck, because there are taxes and there are usually insurance premiums that are going to be taken out along with any retirement contribution. You have to look at take home pay in order to figure out how much money you really have to work with.

So, what do you do from here? Well, after you’ve looked at your income, you need to look at your expenses. You need to have an idea of what will be going on in your finances — if you don’t know what expenses you have, you will have a hard trouble building anything.

If your budget seems okay, then you will want to expand things to look at the big picture. Do you already have life insurance? If not, why not? From there, you have to make sure that your debt is under control and that your credit score is proper. If you don’t know what your credit score is, you need to look getting your credit report and your credit score along with it. You get a free report every year, but you will have to pay a little bit extra to get a credit score. That credit score tells you how you look in the yes of lenders. If you want to get a car or even buy a house, you will need to have better credit.

Overall, you need to just sit back and think about the type of life that you want to live. Now, it can be hard to really think about it in a big way, but the truth is that looking at the big picture helps you define your financial future. If you really think about things as they come along, then you shouldn’t have any problem building a strong financial blueprint over time.